LUG in 2018

LUG Argentina – opening of the first foreign production facility

In the third quarter of 2018, work related to launching the production plant of LUG S.A. Capital Group in Argentina has been completed.

LUG is a member of the World Economic Forum

In 2018, the LUG S.A. Capital Group began efforts to join the group of organizations associated with the World Economic Forum, which were crowned with the beginning of 2019.

Payment of the dividend to LUG S.A. shareholders

On September 19, 2018, the third dividend in the history of LUG was paid out, based on a decision of the General Meeting of Shareholders

LUG Turkey - a new company of the Capital Group

The Capital Group of LUG S.A. has opened a new joint-stock company, LUG Turkey in Istanbul (LUG AYDINLATMA SISTEMLERI ANONİM ŞİRKETİ), as a continuation of strengthening its position on the international lighting market.

Light+Building 2018

On 18 - 23 March 2018 in Frankfurt am Main, one of the largest and most important lighting industry fairs, Light + Building 2018 was held.

LUG Argentina – opening of the first foreign production facility

In the third quarter of 2018, work related to launching the production plant of LUG S.A. Capital Group in Argentina has been completed.

In the third quarter of 2018, work related to launching the production plant of LUG S.A. Capital Group in Argentina has been completed. LUG opened the LED lighting factory in the heart of the Misiones Province, which is the largest concentration of Polonia in Argentina. LUG production plant in Argentina is the largest Polish direct investment in this country and the first LED lighting factory in the history of the company outside of Poland.

The site was opened by the President of LUG S.A., Ryszard Wtorkowski and the Governor of the Province of Misiones, Hugo M. Passalacqua. The event was also attended by representatives of the authorities of the Misiones Province and the city of Posadas, members of the Chamber of Representatives, the Argentinian business community, a delegation from the Polish Embassy in Argentina, the Polish honorary consul in Argentina Mr Miguel Antonio Skowron and the representatives of the Polish community in the region.

The first LUG S.A. Capital Group factory abroad will produce the latest generation of LED lighting luminaires dedicated to urban spaces, road infrastructure, schools, public buildings and industrial facilities.

LUG is a member of the World Economic Forum

In 2018, the LUG S.A. Capital Group. began efforts to join the group of organizations associated with the World Economic Forum, which were crowned with the beginning of 2019.

By becoming a Member of the World Economic Forum, LUG joined the global community of companies, international organizations and other institutions committed to improving the condition of the world. As a company specializing in design, development and manufacturing of comprehensive LED lighting solutions for professional applications such as infrastructural and urban lighting, LUG offers complete solutions for everyday challenges of the modern world, such as improving energy-efficiency, reducing carbon footprint and increasing safety and comfort for ourselves and those around us.

The World Economic Forum is the leading international organization for public-private cooperation committed to improving the state of the world. The Forum engages the foremost political, business and other leaders of society to shape global, regional and industry agendas. The institution blends and balances the best of many kinds of organizations from both the public and private sectors, international organizations and academic institutions.

Payment of the dividend to LUG S.A. shareholders

On September 19, 2018, the third dividend in the history of LUG was paid out, based on a decision of the General Meeting of Shareholders which positively considered the request of the LUG S.A. Management Board and adopted a resolution to enable the payment process.

Shareholders received PLN 1.22 million of profit generated in 2017, which means PLN 0.17 per share.

Detailed parameters of the dividend:

- dividend resolution: PLN 1,223,756.90

- value of the dividend per share: PLN 0.17

- date of setting the right to dividend: 12/09/2018

- dividend payment date: 19/09/2018

LUG Turkey - a new company of the Capital Group

The Capital Group of LUG S.A. has opened a new joint-stock company, LUG Turkey in Istanbul (LUG AYDINLATMA SISTEMLERI ANONİM ŞİRKETİ), as a continuation of strengthening its position on the international lighting market.

The investment on the Eurasian market is another step in the implementation of LUG strategic objectives for years of 2017-2021. Establishment of LUG Turkey is a part of the internationalization strategy implemented by LUG S.A. Capital Group, which aims to increase and enhance the presence of LUG on international markets, which is included in indicators of export share in the Group's revenues.

Light+Building 2018

On 18 - 23 March 2018 in Frankfurt am Main, one of the largest and most important lighting industry fairs, Light + Building 2018 was held.

Every year, the Light + Building trade fair attracts over 200,000 professionals to Frankfurt, looking for the latest, most innovative solutions for the lighting and construction industry. Each edition of the meetings is related to the currently prevailing trend in the industry. The main theme of the event of 2018 was the "Connected - Secure - Convenient", i.e. intelligent network lighting solutions that increase the safety and comfort of users while at the same time taking care of the economic efficiency of buildings. The future of the industry is aesthetics and functionality created for the needs of the human body and the impact of light on the human psyche. LUG as one of the exhibitors presented a wide spectrum of innovative solutions designed to meet the widest range of needs of its business partners. The company's stand with an area of 240 sq meters reflected the strategic directions of LUG development. In three unique zones of the stand, solutions dedicated to strategic target groups: architects, interior designers and city authorities, were presented.

The stand has been noticed and acknowledged by winning the prestigious Honorable Distinction of the 57th edition of StandOUT Light + Builing Competition in the category over 200 square metres stand.

LED market forecasts

62MLD US$

World

11,5MLD US$

Europe

9%

CAGR

112MLD US$

World

30MLD US$

Europe

Industry development factors

According to international forecasts, in 2018-2023, the value of the global LED lighting market will gradually increase to reach USD 112 billion in 2023, with a CAGR value of 9%.

IoT

Smart lighting is the most powerful instrument for the development of IoT towards the technology of the future that puts human needs at the center - its safety, comfort of life - and at the same time it neutralizes its impact on the environment. Innovations of LUG from the IoT area are implemented by the technology company of the Capital Group - BIOT Sp. z o.o.

Global IoT Market Share by Sub-Sector

Source: GrowthEnabler Analysis

Global Iot Market Size (in Billions US $)

and Growth Rate YoY

Source: GrowthEnabler Analysis/MarketsandMarkets

Strategic Directions of Development

Strategic development areas:

Innovation

We create light, not solutions

Internationalization

We create emotions, not feelings

Organizational culture

We are a LUG Family, not just a team

MISSION

We create an innovative light for life with passion.

VISION

International leader of innovative lighting solutions.

Our values

Strategic objectives

Main objective

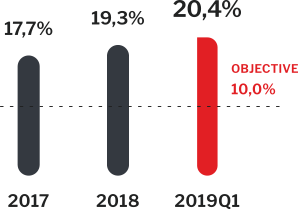

Achieving growth rate of the LUG S.A. Capital Group in relations to 10% CAGR sales revenue in the next 5 years

Supporting objectives

Increase

To increase the share of completed projects, valued at more that 1 milion Euro, to 10% of sales revenue by the end of 2021

Globalization

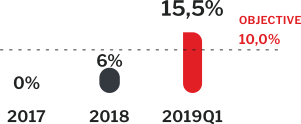

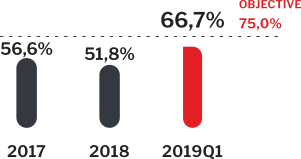

Increase in the share of export revenues to 75% of the revenues of the capital group by the end of 2021

Margins

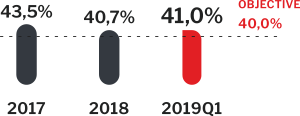

To increase gross margin on sales to exceed 40% over the next few year and sustain it at that level

LUG in the market

In 2018, the company sold its products to:

70 countries

- Algeria

- Argentina

- Armenia

- Australia

- Austria

- Azerbaijan

- Bahrain

- Belarus

- Belgium

- Bosnia and Herzegovina

- Brazil

- Bulgaria

- China

- Chile

- Croatia

- Curacao

- Czech Republic

- Denmark

- Egypt

- Estonia

- Finland

- France

- Georgia

- Germany

- Great Britain

- Greece

- Holland

- Hungary

- Iceland

- India

- Iraq

- Iran

- Ireland

- Israel

- Italy

- Kazakhstan

- Kuwait

- Latvia

- Lebanon

- Lithuania

- Luxembourg

- Macedonia

- Malta

- Mauritius

- Moldovia

- Montenegro

- Morocco

- New Zealand

- Norway

- Oman

- Peru

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Salvador

- Saudi Arabia

- Serbia

- Slovakia

- Slovenia

- South Africa

- South Korea

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Arab Emirates

- Vietnam

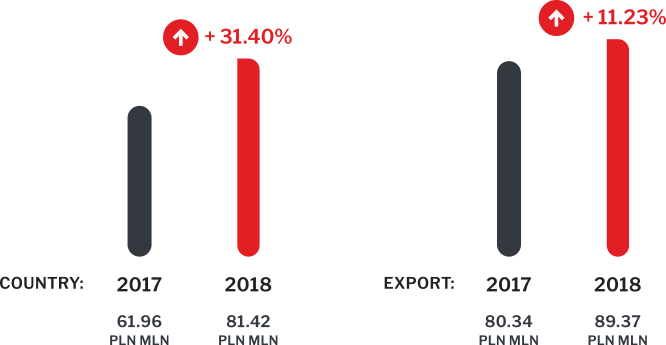

Incomes

Incomes structure (PLN mln)

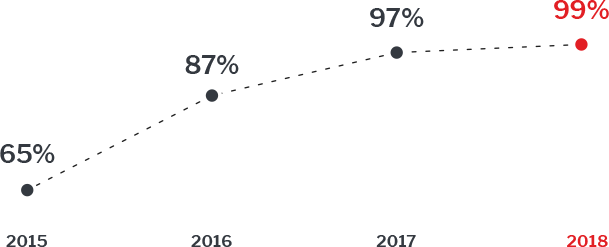

Participation of LED

Participation of LED luminaires in LUG’s sales of lighting luminaires

Products

Get inspired by the LUG Architecture product portfolio

Architecture

Get inspired with the LUG Urban portfolio

UrbanNon-financial report of the LUG S.A. Capital Group

We would like to provide you with the first LUG non-financial report. It is a source of a summary of information from the most important areas, such as social, employment, environment, human rights and anti-corruption issues.

These matters define the environment of LUG development. We made detailed identification of the impact we exert on specific areas and how they affect us. We have identified significant non-financial risks and described how we manage them."

President of the LUG S.A. Management Board

Corporate governance

The LUG S.A. Capital Group ensures that relations with investors are built on the basis of partnership and pays great attention to granting free access to information about the Issuer to all shareholders and to respecting their rights, regardless of the size of their block of shares.

The corporate governance relating to the broadly understood management of the company accompanies the operations of the LUG S.A. Capital Group over the years. In 2018, LUG S.A. continued to apply principles of “Good Prac-tices of Companies Listed on the NewConnect”, applied to companies listed in an Alternative Trading System of Giełda Papierów Wartościowych w Warszawie S.A. (Warsaw Stock Exchange) and adapted to the applicable regulations in accordance with the highest standards.

Risks related to the environment

-

Risk

related to macroeconomic and industry situation

-

Risk

of volatility in the legal environment

-

Risk

risk of variability of tax regulations and their interpretation

-

Risk

of incorrect assessment of the macroeconomic situation and trends in the lighting industry

-

Risk

related to financing with foreign capital and changes in interest rates

Risks related to the business activity

-

Risk

related to the seasonality of sales

-

Risk

of random events

-

Risk

related to liability for damage to persons and property in connection with the use of products offered by the Issuer

-

Risk

related to the withdrawal of production batches from the market

-

Risk

of losing key employees and key management members and the inability to employ a sufficient number of qualified employees

-

Risk

related to court proceedings, arbitration proceedings and proceedings before administrative bodies

-

Risk

related to environmental protection

-

Risk

related to the temporary suspension of production as a result of failure, destruction or loss of property

-

Risk

related to the implementation of the contract with the Government of the Misiones Province and the development of activities in Argentina

-

Risk

related to the supply chainrelated to the supply chain

-

Risk

risk of achieving strategic goals

-

Risk

of deterioration of reputation and loss of customer confidence

-

Risk

exchange rate

-

Risk

related to penalties for non-performance or untimely performance of orders

-

Risk

of rising prices of raw materials and components

-

Risk

related to competition

-

Risk

related to the repayment of receivables by contractors

-

Risk

related to the increase in operating costs

Privacy policy

1. General information.

- The raportroczny2018.lug.com.pl Website operator is LUG S.A. with its registered office at ul. Gorzowska 11, 65-127 Zielona Góra; tax ID No. (NIP): PL 929-17-85-452

- The Website gathers information about users and their behaviour through cookie files saved in data terminal equipment.

2. Information on cookies.

- The Website uses cookies.

- Cookies are computer data, in particular in the form of text files, which are stored in the data terminal equipment of the Website User and are intended to be used when navigating the Website. Cookies typically contain the name of the website of origin, the storage time on the data terminal equipment and a unique number.

- The entity that places cookies on the Website User’s data terminal equipment and gains access to them is the Website Operator.

- Cookies are used for the following purposes:

- to create statistical data that offers insight into how Website Users navigate web pages, which allows their structure and content to be improved;

- to maintain the Website User’s session (after logging in) in order to avoid the need to re-enter the login and password on every subpage;

- to establish the user profile in order to display the user-tailored content in advertising networks, in particular the Google network.

- The Website uses two basic cookie types: session cookies and persistent cookies. Session cookies are temporary files stored on the User’s data terminal equipment until the User logs off, leaves the website or exits software (web browser). Persistent cookies are stored on the User’s data terminal equipment for a fixed period of time as specified in the parameters of the cookies themselves or until removed by the User.

- The software used to browse websites (a web browser) usually permits cookies to be stored on the User’s data terminal equipment by default. Website Users can modify browser settings at any time. The web browser allows cookies to be deleted. It is also possible to block cookies automatically. For detailed information please refer to your browser’s help menu or documentation.

- Restricting the use of cookies may affect some of the features and the functionality of the Website

- Cookies saved on the Website User’s data terminal equipment may also be used by the advertisers and partners collaborating with the Website Operator.

- We recommend reading the privacy policy of such entities in order to learn the rules of using cookies in statistics: Privacy Policy of Google Analytics

- Cookies may be used by advertising networks, and the Google network in particular, to display advertisements tailored to the use pattern of the Website User. For this purpose they may retain information about the user navigation path or the time spent on a given page.

- With regard to information about user preferences collected by the Google advertising network the user may browse and edit information stored in cookies using the following tool: https://www.google.com/ads/preferences/

3. Disclosure of data.

- Data may be disclosed to third parties only to the extent permitted by the laws in force.

- Any data that would enable a natural person to be identified can only be disclosed with that person’s consent.

- The Operator may be required to provide the information gathered by the Website to authorised bodies based on legitimate demands arising from the demand.

4. Managing cookies – how to express and withdraw consent in practice?

- If users do not wish to receive cookies, they can modify their browser settings. Please note that switching off the handling of cookies necessary for authentication, security and saving user preferences may hinder and in extreme cases even prevent the use of the Website.

- To manage your cookie settings please select your web browser/system from the list below and follow the instructions:

- The Website Operator informs you that restricting the use of cookies may affect some of the features and the functionality of the Website.

- You can find more information about cookies athttps://pl.wikipedia.org/wiki/HTTP_cookie or in the “Help” section of your browser menu.

- Should you have questions regarding our privacy policy, you can contact us at interactive@artgroup.pl or Monika.Bartoszak@lug.com.pl

- Any modifications to the privacy policy will be announced by an amendment to this text.